Psd2 Banking License

Open bank project delivers berlin group 1 3 apis to production commercial license holders so they can fulfill their psd2 compliance requirements.

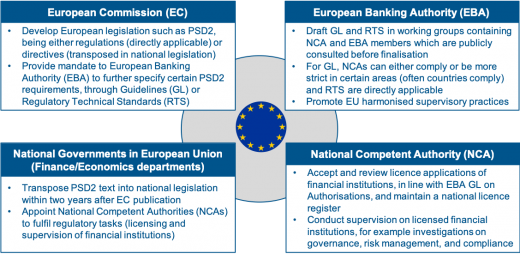

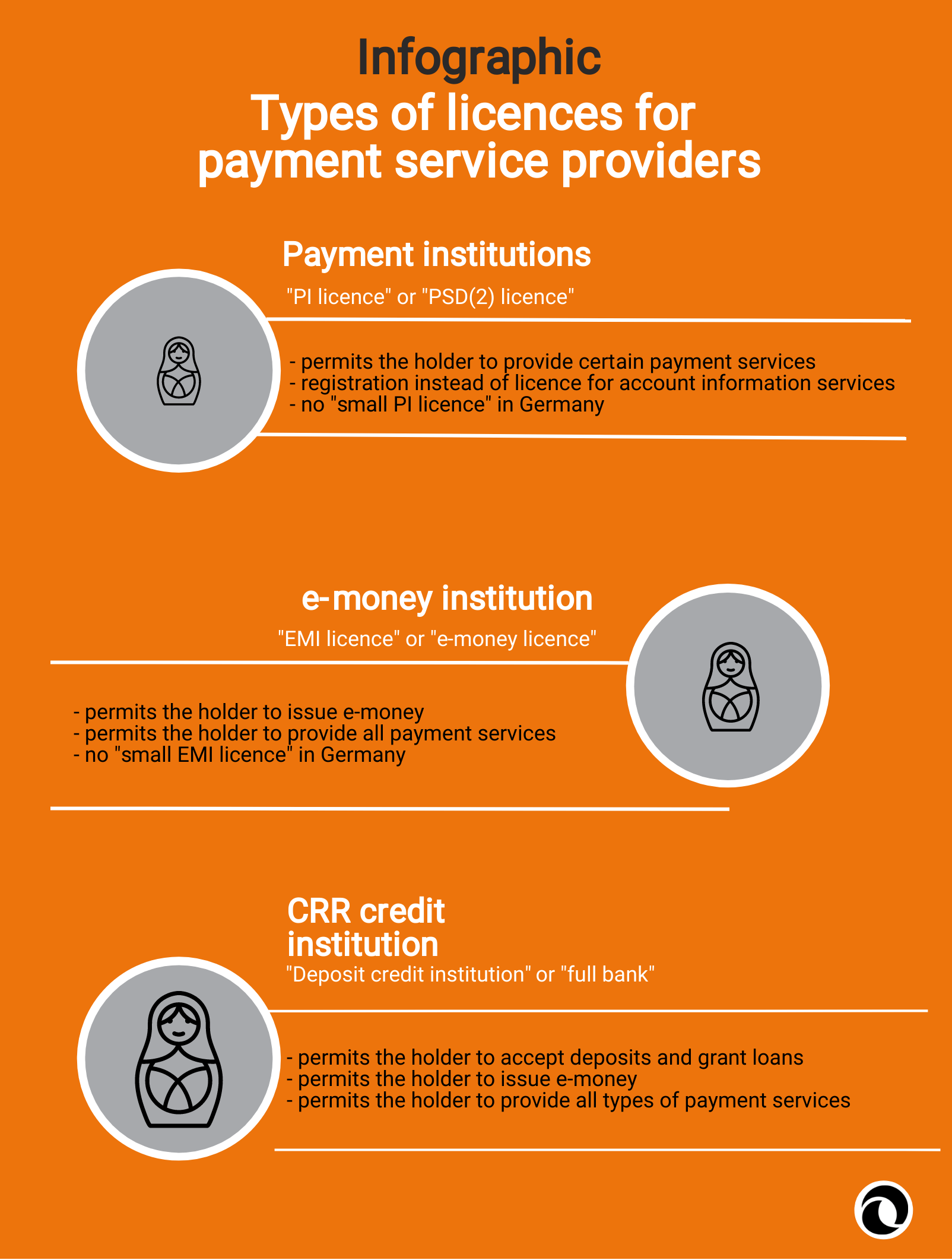

Psd2 banking license. The berlin group is a standards initiative and api framework that helps banks comply with psd2 regulation. On may 21 2020 revolugroup became the first canadian company to be granted the prestigious psd2 banking license via the company s barcelona based wholly owned subsidiary revolupay s l. It can also be another bank. The picture below provides a simplified overview of the four key stakeholders within the eu who are involved with the design and.

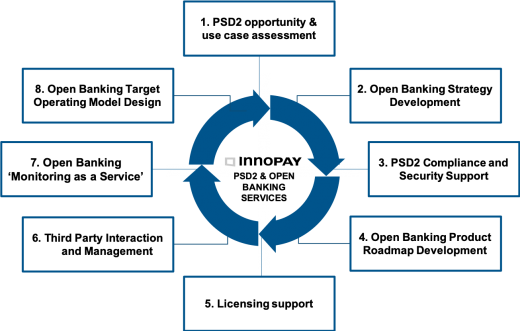

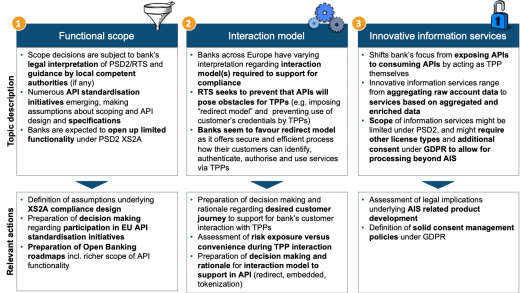

Forget all the confusion as we provide you with a clear view on the most relevant topics. Became the first new entity to be granted the coveted pan european psd2 open banking license by the central bank of the kingdom of spain. Under their banking licence banks are also. The nfps is a platform representing fifteen civil society organisations for consumers retailers and banks.

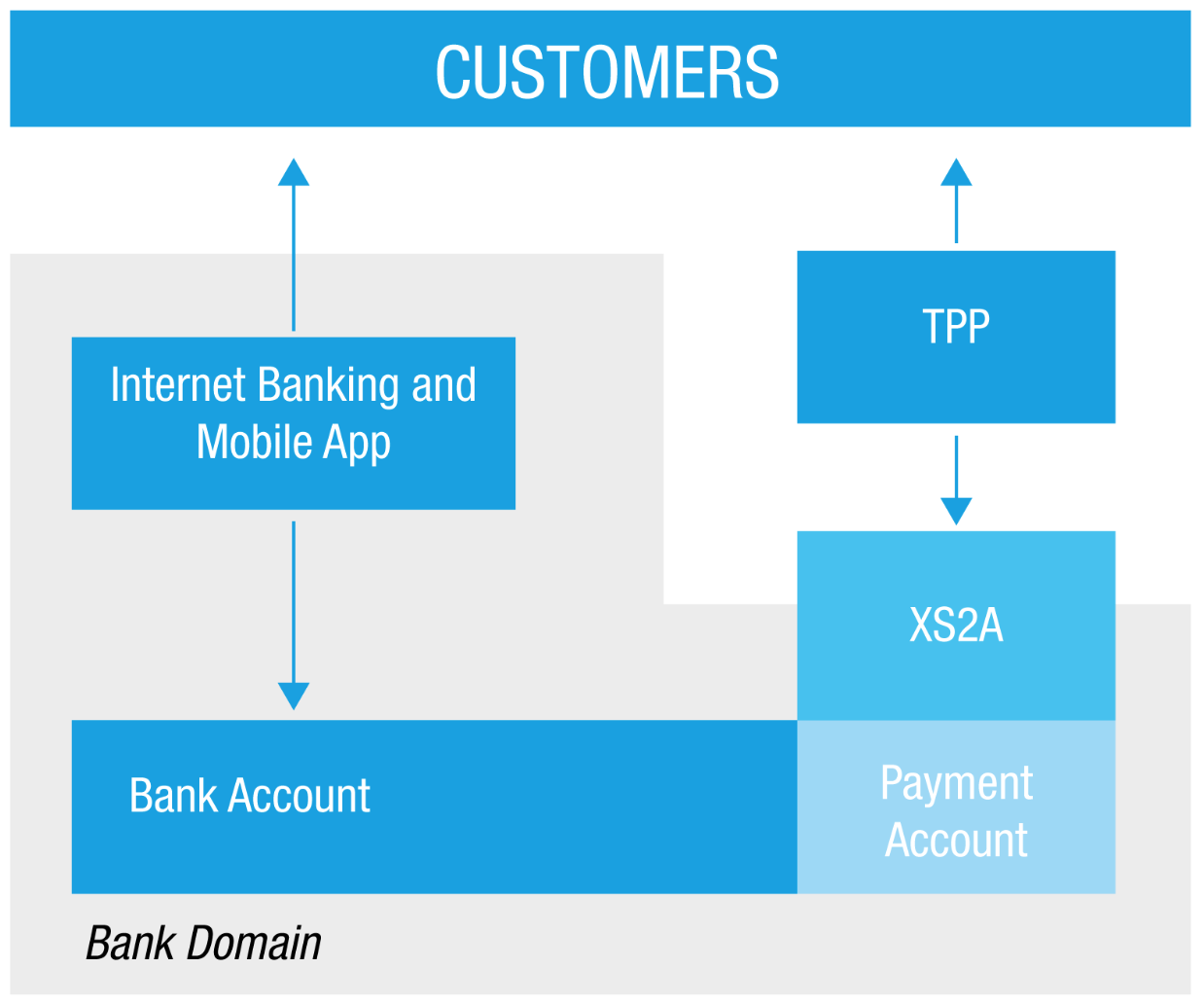

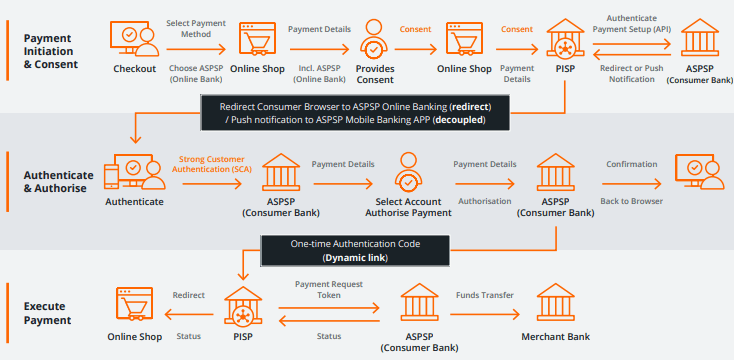

Psd2 introduces new rights for certain third party providers tpps to directly access payment service users online payment accounts with their explicit consent and requires account servicing payment service providers aspsps such as a bank to permit access through a dedicated. Open banking helps the financial sector to make a huge jump to catch up with the rest of the industries in terms of digitalization of the services and customer experience. One additional achievement was that revolupay s l. Overview of the psd2 regulatory landscape a lot has been said and written on psd2 often leading to misinterpretations of the timelines and requirements of becoming a tpp.

The revised payment services directive psd2 went into effect on 13 january 2018 across the uk and europe.